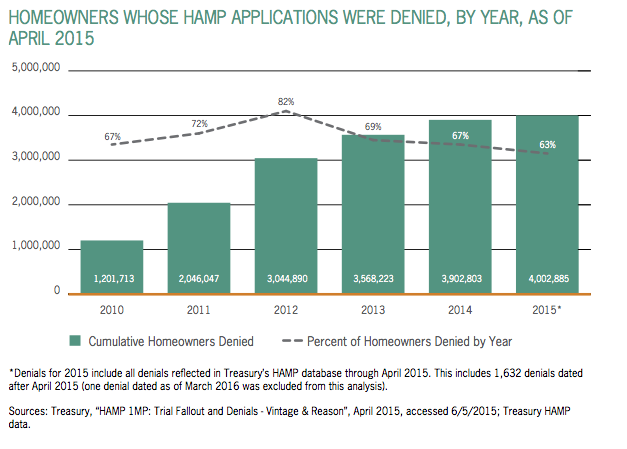

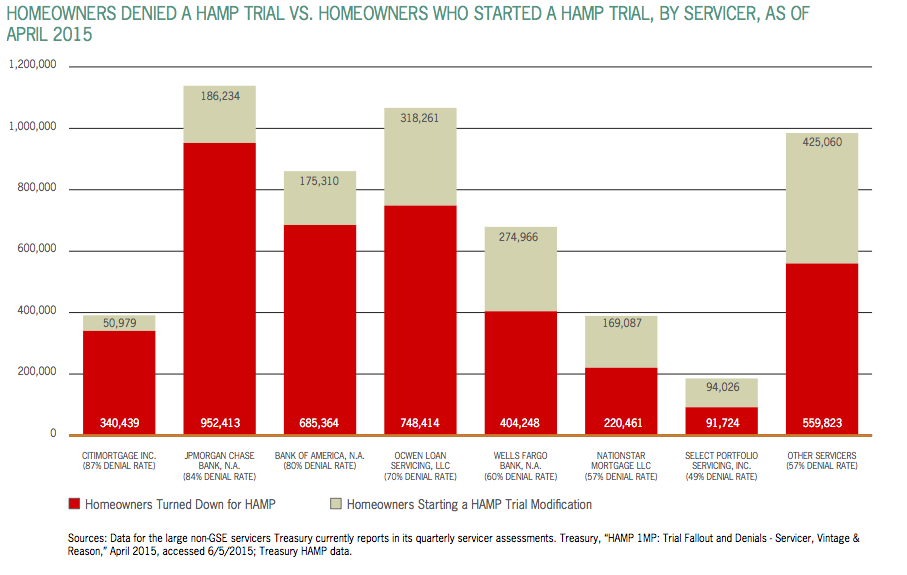

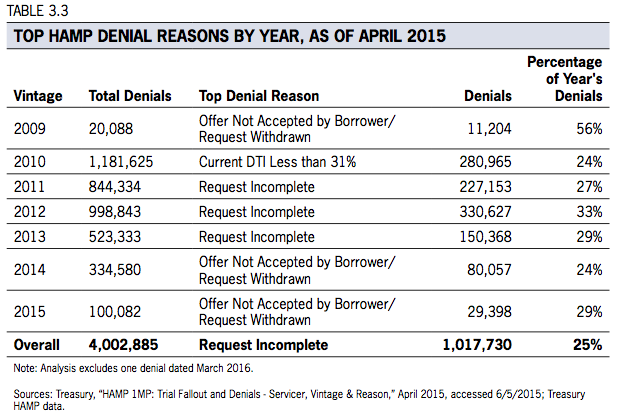

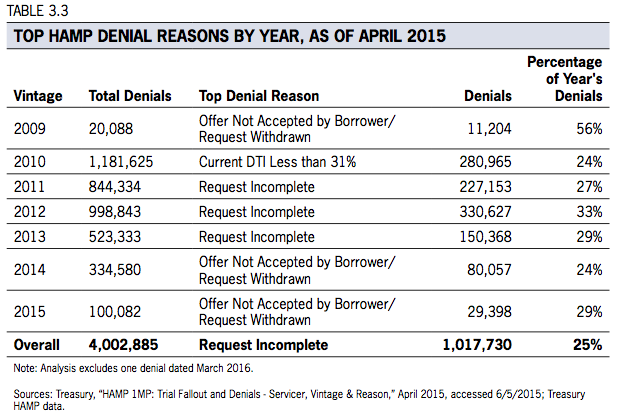

“Servicers reporting to Treasury attribute most denials to the same few categories, all of which relate to the fault of the homeowner or the homeowner falling outside of eligibility standards,” said Romero.

“Even if some people did not meet Treasury’s eligibility standards, SIGTARP has repeatedly pointed out, and Treasury has found in their reviews, known problems by the largest HAMP servicers that have plagued homeowners, for example, income calculation errors, lost paperwork, and improper denials. Servicer reporting to Treasury that most HAMP denials related to the homeowner in light of known servicer misconduct raises concerns over the accuracy of servicer reports,” Romero continued.

When it comes to servicer issues, SIGTARP has reported on lengthy backlogs up to or even more than one year for some HAMP servicers. Sometimes the homeowner turns in all required documentation, but the servicer loses it.

SIGTARP has also reported on problems with paperwork being delayed or lost when a servicer transfers the mortgage while the HAMP application is pending.

“HAMP has existed too long for servicers to not follow HAMP’s rules every time. Homeowners deserve a fair review. Treasury has a small window of opportunity to figure out why so many people have been denied HAMP and to establish a zero tolerance standard for servicers who do not follow HAMP’s rules,” said Romero.

As a result of the fining, SIGTARP suggested Treasury can do the following to the help:

- Treasury needs to understand the real causes of homeowner denials and act to ensure servicers are treating homeowners who apply for HAMP fairly.

- Treasury should hold servicers accountable for extensive delays, lost paperwork, and errors in calculating key eligibility factors such as income.

- Treasury should make a course correction to reduce servicers’ high rates of denying homeowners seeking to get into the program.

- If Treasury does not take stronger action, servicers will have no reason to change.

- Treasury should use its full authority, including the power to permanently withhold TARP incentive payments from servicers who fail to perform to enforce those obligations and protect homeowners.

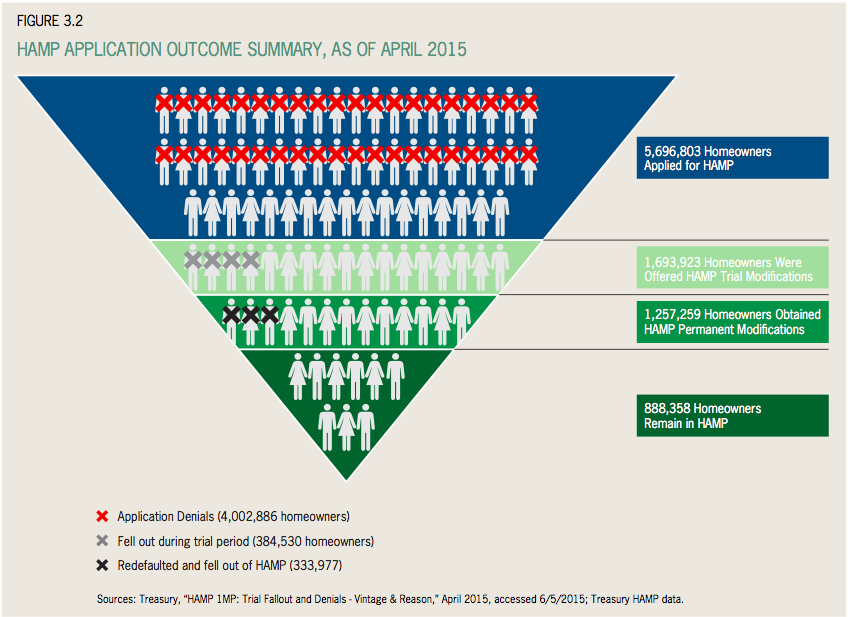

In response, Mark McArdle, treasury chief of the homeownership preservation office, said, “HAMP has directly helped more than 1.5 million homeowners permanently modify their mortgages and indirectly assisted millions more by setting new standards for the mortgage industry that have led to more affordable and sustainable private modifications.”

“Treasury closely monitors the number of HAMP denials and has made changes to the program to simplify documentation requirements and expand eligibility criteria to assist more homeowners. In addition, Treasury has robust compliance procedures to test whether servicers are adhering to program requirements and we’ve publicly reported on these findings since 2011. In recent years, we have seen significant improvement in servicers’ compliance with program guidelines, including proper evaluation and denial decisions,” he continued.

To read this full article and related HAMP articles on HousingWire.com Click Here